Second Mortgage Loan Benefits & Guidelines

The term “second mortgage” can be used to refer to home equity loans and home equity lines of credit (HELOCs). All of these loans are taken out on a property that already has a first mortgage.

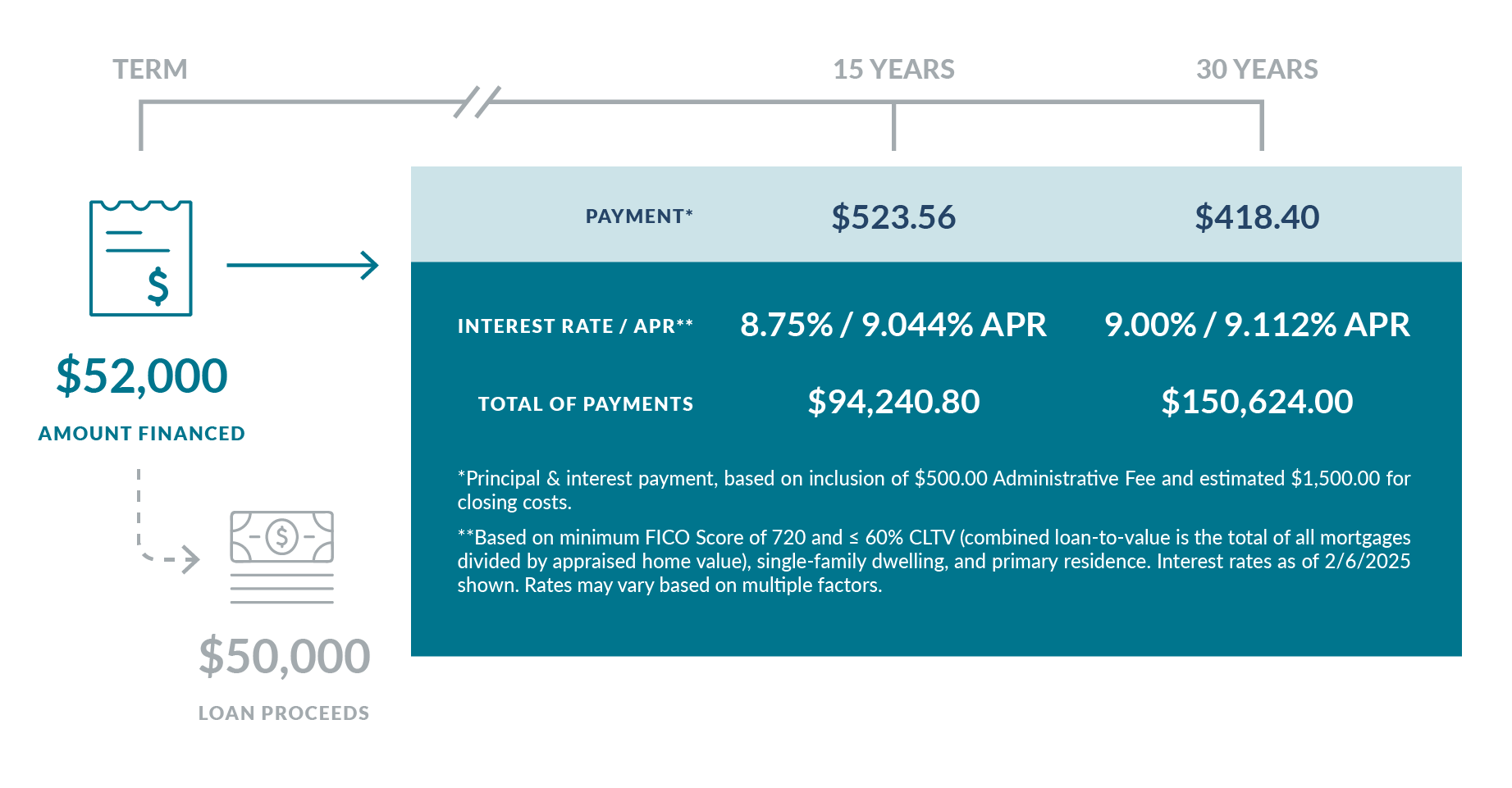

Sample Payments

Second Mortgage Guidelines

- Loan amounts from $25,000 to $350,000

- Terms of 15 or 30 years

- Up to 85% of your home's value (including the first mortgage balance)

- No prepayment penalty

- Low closing costs

- Quick approval and funding process

Not sure if a second mortgage is right for you?

Inquire today and we’ll connect you with a Military Mortgage Advisor who can help you explore your options. Or, give us a call at 844-422-3622.

Today's Mortgage Rates

Disclaimer: these are sample rates and terms based on daily pricing that fluctuates and is subject to change and credit approval. Parameters: 720+ FICO, Single-Family Residence, $300,000 loan amount, State = NC, County = Wake, Discount Points range from 0.0% to 2.0% as shown above under the "Fees" column, Admin Fee = $1,149. For VA Home Loan, assume a 2.5% VA Funding Fee. For VA Cash-Out Refinance, assume the borrower is exempt from the VA Funding Fee.