When you’re talking with a loan officer, it can seem like they're speaking in a foreign language as they throw around terms like DTI, LTV and ARM. Don’t worry; we’ve got you covered (and anytime you have a question, just ask your AAFMAA Mortgage Services LLC (AMS) Military Mortgage Advisor)!

What Is APR on a Mortgage?

One term you're sure to encounter on your home buying journey is the Annual Percentage Rate (APR). While it might seem like just more lingo, APR plays a critical role in understanding the true cost of a mortgage.

APR is a percentage that represents the total yearly cost of borrowing. It includes not just your loan's interest rate, but also various fees and closing costs. Because of this, your APR will usually be higher than the interest rate alone.

Think of it as the full price tag on your loan. If you're comparing two mortgage offers, the APR gives a clearer picture of which mortgage will cost you more over time — even if both have similar interest rates.

For example, one lender might offer a low interest rate but charge high upfront fees, resulting in a higher APR. Another lender might offer a slightly higher rate with minimal fees, leading to a lower APR overall.

That's why you want to focus on APR — rather than just the interest rate.

Related: Most Important Mortgage Acronyms Cheat Sheet

APR vs. Interest Rate: What’s the Difference?

Your interest rate is the cost of borrowing the principal amount of your loan. It’s what your monthly mortgage payment is based on (not including taxes or insurance). The APR reflects your interest rate plus certain fees and costs rolled into the loan.

Here’s an example:

Bank A is offering you a 30-year fixed mortgage with a 6.375% interest rate and a 6.652% APR, while Bank B offers you a similar loan with a 6.250% interest rate but a 6.389% APR.

Although Bank B has a slightly lower rate, the difference in APR shows the true cost is more favorable. Always compare APR to APR, and interest rate to interest rate.

Fixed vs. Adjustable APRs

As a military homebuyer, you may be relocating more often than civilians, which could influence your decision between fixed and adjustable-rate mortgages.

Fixed-Rate Mortgages — With a fixed-rate mortgage, your APR remains the same for the life of the loan. If you lock in a 30-year fixed mortgage, you'll enjoy consistent payments and predictability.

Adjustable-Rate Mortgages (ARMs) — An adjustable-rate mortgage usually starts with a lower introductory interest rate and APR, but after a few years, both can increase based on market conditions.

Related: Is An Adjustable-Rate Mortgage (ARM) Right for Me?

What Fees Are Included in APR?

The APR calculation includes most of the fees you’ll pay over the life of the mortgage. These often include:

- Origination Fees — What the lender charges to process your loan.

- Mortgage Points — Optional fees paid upfront to lower your interest rate, known as “buying down the rate”.

- Some Closing Costs — For example, lender fees and prepaid items.

- VA Funding Fee — With a VA Home Loan, this fee can be paid in full at the closing table or rolled into the loan.

- Underwriting Fees — Costs for the lender’s evaluation of your creditworthiness.

- Broker Fees — If you use a mortgage broker to find your loan.

What Fees Are Not Included in APR?

Some out-of-pocket expenses won’t show up in the APR but still impact your homebuying costs:

- Credit Report Fees

- Home Appraisal Fees

- Property Survey Fees

- Flood Certification Fees

- Escrow/Settlement Fees

- Recording Fees (to file your deed)

- Prepaid Expenses, such as homeowners insurance, property taxes, interest paid before your first mortgage payment, and prepaid mortgage insurance (if required) for a conventional mortgage. These expenses may not affect your APR, but they should still be factored into your budget.

How APR Changes Based on Points and Fees

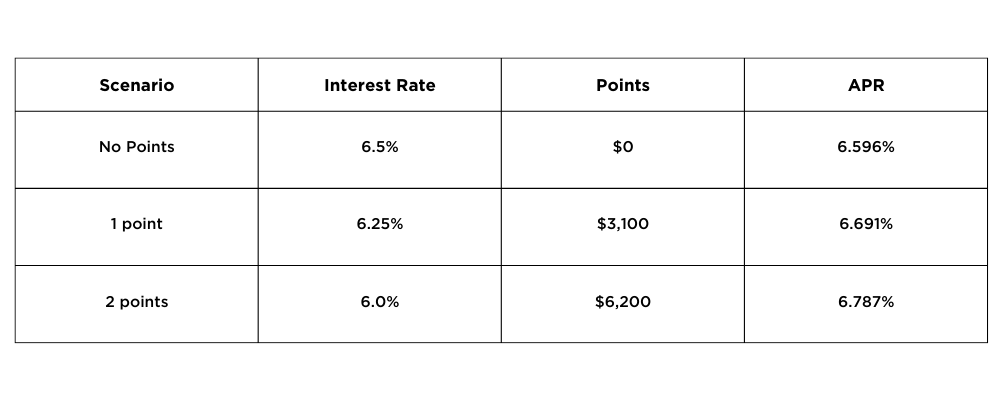

Let’s say you’re borrowing $310,000 on a 30-year fixed mortgage. Here’s an example of how buying “points” affects your APR:

While buying points lowers your interest rate, it increases your upfront cost and often raises your APR slightly. Make sure you’ll stay in the home long enough to recoup the savings.

How to Calculate APR

Fortunately, you don’t need to calculate APR yourself — lenders are required to disclose it. But if you want to double-check or estimate it, here's the basic method:

- Add the total interest and loan fees.

- Divide that total by the loan amount.

- Divide by the number of years in the loan term.

- Multiply by 365.

- Multiply by 100 to get the percentage.

How Military Homebuyers Can Lower Their APR

While market rates are beyond your control, there are steps you can take to improve your loan terms:

- Improve Your Credit — Higher credit scores usually mean lower rates and lower APRs.

- Make a Bigger Down Payment — Reduces the VA funding fee or may eliminate PMI on other types of mortgages, both of which improve your APR.

- Choose a Shorter Loan Term — 15-year loans usually come with lower APRs, although the monthly payments are higher.

- Use VA Loan Benefits — If you're eligible, a VA Home Loan can offer competitive rates, no private mortgage insurance (PMI), and reduced upfront costs — keeping your APR lower.

Embrace the APR

For military families and servicemembers, understanding mortgage APR is more than just learning finance — it’s about making smart, long-term decisions for your future. Whether you’re stationed stateside or preparing for your next PCS, knowing how APR works will empower you to find the right mortgage — and keep more of your hard-earned money.

As you compare loan offers, remember: APR is your best friend for evaluating the true cost of borrowing. Look beyond the surface of low rates, and dig into the details that matter most to your bottom line.

We’re Here to Help

Whether you’re thinking about buying, ready to start home-shopping in earnest, or considering a refinance, one of our Military Mortgage Advisors, a licensed mortgage loan originator, will be happy to provide you with an honest and fair comparison of your mortgage options, including a wide range of affordable mortgages designed to meet your needs.

Ensuring Armed Forces Mutual Members obtain the best mortgage possible is our mission. Get your free mortgage assessment today or give us a call at 844-422-3622!